“Twelve Pillars to Your Business Success”

Pillar Three Profit Chapter Three

What we discuss in Pillar Three:

- Profit and Loss

- Budgeting

- Balance Sheet

- Cash Flow

- Break Even

- Cost of Doing Business

- Cash Gap

- Accounts Payable and Receivable

- KPI’s

- The profit levers – Prospects, Conversion Rate, Average $ Spend, Number of Transactions, Gross Profit

Knowing your numbers is the key to running most successful businesses. Successful business owners and operators know their Sales, Break Even, and Profit on a daily basis, they live and breathe these numbers and many more that indicate the health of their business.

When I was in my corporate life typically the first thing I did every morning was review the key numbers from the previous day – Total Sales, Total Gross Profit, Number of Transactions, Sales of individual key products, etc. This was often by outlet across the company.

Knowing Your Numbers in detail allows you to make better business decisions and thus drives your business in the right direction. This is a positive habit that all key people in any business must develop to be successful.

Please do not put the numbers in the too hard basket…….if you have issues understanding your financials seek help to learn, employ team members who can assist and take time to discuss with your accountant and ask them to dig deeper than tax compliance.

OK, let’s review the key areas that you must know in a little more detail. To me, the two most important numbers in a small and medium business are Break Even and Gross Profit. Why? Because these are very clear indicators of your profitability. To understand Break Even and Gross Profit you should have a Profit and Loss statement, so let’s start there.

Profit and Loss

Depending on your business, your P&L may be controlled via a proprietary program such as MYOB or Xero or you may use a simple spreadsheet. Whatever you use your P&L will record in whatever terminology you use:

- Sales/Income/Revenue

- Cost of Sales/Variable Costs/Cost of Goods

- Gross Profit

- Fixed Expenses

- Net Profit

- Sales – Cost of Sales = Gross Profit – Fixed Expenses = Net Profit

- Sales/Income/Revenue: Is the total income that flows into your business from sales activity regardless of the type of product, service or goods you are selling.

- Cost of Sales/Variable Costs/Cost of Goods: These are costs that your business incurs only when making a sale. They include cost of the products you sell, labour that works only when selling, freight to deliver goods, packaging, etc. In other words if you did not sell the product or service you would not incur the cost.

- Gross Profit: Simply, this is what is left after you subtract total Cost of Sales from total Sales. Why is Gross Profit so important? Because Gross Profit is what is left from Sales to pay all the other fixed expenses.

I am always surprised at the confusion between mark up on cost and Gross Profit. Business owners will mark a product up by 100% and think they have made 100% profit when in fact they have made 50%

Cost $100 x 100% = $200 Selling Price but what is left after the sale is $100.

$100 divided by the Selling Price equals 50% not 100%. It is that 50% of Sales that you have left to pay expenses. If your expenses are over 50% of sales you are in the red. More on that a little later.

- Fixed Expenses: These are the expenses that are incurred regardless of your business selling anything. Fixed Expenses include, wages, rent, motor vehicles, professional fees, training, office supplies, etc.

- Net Profit: This is what is left from your Gross Profit after all expenses are paid.

Example 1. Sales $100,000 % to Sales 100%

Cost of Goods $60,000 % to Sales 60%

Gross Profit $40,000 % to Sales 40%

Total Expenses $25,000 % to Sales 25%

Net Profit $10,000 % to Sales 15%

Understanding the number and the percentage ratios allows you to level the playing field regardless of the income.

Using Example 1, you know your GP% must be at least 40% to cover costs and produce a profit.

Let’s see what happens when we increase Sales and reduce Gross Profit.

Example 2: Sales $200,000 % to Sales 100%

Cost of Goods $150,000 % to Sales 75%

Gross Profit $50,000 % to Sales 25%

Total Expenses $40,000 % to Sales 20%

Net Profit $10,000 % to Sales 10%

In Example 2, sales doubled, cost of sales increased, expenses increased and profit remained the same. Had the GP% remained at 40% the business would have made $40,000. Understand and protect your gross profit.

There are only three ways to improve your gross profit – lower your cost of sales, increase your prices or sell a different mix of products (sell more higher margin products).

One of my favourite discussions with clients starts with this simple question “When was the last time you increased your prices?” All too often the answers are, “not for several years”, “we can’t increase or our customers will leave”, “we have never increased” or “only when our costs increase”.

Increasing prices is a normal part of doing business and can be driven by many things. Certainly increases in your costs should be covered, reviewing your competitor’s activity, overall market conditions and simple opportunities to make more should all be reviewed regularly. Clearly if your costs increase and you do not move your selling price you are making less profit. See the price increase chart below.

Additionally I am also surprised when business owners do not negotiate with their suppliers for lower cost of goods. Simply asking the question “what can I do to achieve a discount on your goods or services?” may reveal significant additional profit. It’s OK to negotiate.

Typically business owners do not understand that the different products and services they offer will have different levels of profit. When this is understood a greater focus can be placed on higher profit offerings, thus changing the mix and increasing Gross Profit.

Higher Gross Profit gives a business more $$$’s to pay expenses and more $$$’s flow to Net profit.

Budgeting

Once the Profit and Loss is understood the next step is to build a P&L budget to track the changes in sales and expenses and to track your success or otherwise against pre- determined targets.

P&L budgets typically are set by month and show Last Year, Budget This Year and Actual This Year…below is an example. Once this is constructed the analysis of the business performance by month and year to date is easily done.

P&L Budget 2015 – 2016 |

July |

August |

||||

Company ABC |

Act, T/Y 2015-16 | Budget 2015-16 | Last Year 2014-15 | Act, T/Y 2015-16 | Budget 2015-16 | Last Year 2014-15 |

| Product A | $ 90,000 | $ 80,000 | $ 75,000 | $ 80,000 | $ 70,000 | $ 80,000 |

| Product B | $ 180,000 | $ 150,000 | $ 120,000 | $ 170,000 | $ 140,000 | $ 105,000 |

| Product C | $ 300,000 | $ 320,000 | $ 320,000 | $ 380,000 | $ 370,000 | $ 340,000 |

| $ – | $ – | $ – | $ – | $ – | $ – | |

| Total Income | $ 570,000 | $ 550,000 | $ 515,000 | $ 630,000 | $ 580,000 | $ 525,000 |

Cost Of Sales |

||||||

| Product A | $ 70,000 | $ 60,000 | $ 55,000 | $ 95,000 | $ 80,000 | $ 70,000 |

| Product B | $ 100,000 | $ 100,000 | $ 85,000 | $ 85,000 | $ 90,000 | $ 85,000 |

| Product C | $ 180,000 | $ 200,000 | $ 190,000 | $ 230,000 | $ 210,000 | $ 200,000 |

| $ – | $ – | $ – | $ – | $ – | $ – | |

| Total Cost Of Sales | $ 350,000 | $ 360,000 | $ 330,000 | $ 410,000 | $ 380,000 | $ 355,000 |

Gross Profit |

$ 220,000 | $ 190,000 | $ 185,000 | $ 220,000 | $ 200,000 | $ 170,000 |

| % To Total | 39% | 35% | 36% | 35% | 34% | 32% |

Expenses |

||||||

| Accounting | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 |

| Rent | $ 8,000 | $ 8,000 | $ 8,000 | $ 8,000 | $ 8,000 | $ 8,000 |

| Marketing | $ 8,000 | $ 7,500 | $ 6,000 | $ 8,000 | $ 7,500 | $ 6,000 |

| Utilities | $ 400 | $ 400 | $ 400 | $ 500 | $ 500 | $ 450 |

| Phone | $ 550 | $ 500 | $ 450 | $ 550 | $ 500 | $ 450 |

| Motor Vehicle | $ 1,500 | $ 1,500 | $ 1,400 | $ 1,500 | $ 1,500 | $ 1,400 |

| Motor Vehicle Fuel | $ 500 | $ 450 | $ 400 | $ 500 | $ 450 | $ 400 |

| Insurance | $ 800 | $ 800 | $ 750 | $ 800 | $ 800 | $ 750 |

| Salaries and Wages | $ 40,000 | $ 38,000 | $ 35,000 | $ 39,000 | $ 37,000 | $ 36,000 |

| Superannuation | $ 4,000 | $ 3,800 | $ 3,500 | $ 3,900 | $ 3,700 | $ 3,600 |

| Team Ammenties | $ 300 | $ 250 | $ 200 | $ 300 | $ 250 | $ 200 |

| Travel | $ 5,000 | $ 4,500 | $ 4,000 | $ 6,000 | $ 5,500 | $ 4,500 |

| $ – | $ – | $ – | $ – | $ – | $ – | |

| Total Expenses | $ 71,050 | $ 67,700 | $ 62,100 | $ 71,050 | $ 67,700 | $ 63,750 |

| Operating Trading | $ 148,950 | $ 122,300 | $ 122,900 | $ 148,950 | $ 132,300 | $ 106,250 |

| % To Total | 26% | 22% | 24% | 24% | 23% | 20% |

Balance Sheet

The Profit and Loss reports on the trading position of your business, it shows how your business is progressing in terms of sales and profit, helps highlight expense issues and can show how you are tracking against budget and the previous year.

Your Balance Sheet shows the true value of your business at a point in time. The Balance Sheet takes into account Debtors, Borrowings, Assets, Equity, Value and Liabilities. Your Balance Sheet shows the health of your business. There are many ways to analyse your Balance Sheet and the way it is interpreted can depend on the age and life cycle of your business.

Assets are the things owned by the business. There are two types of Assets – Fixed and Current Assets. Fixed Assets are things such as equipment and machinery that cannot be quickly turned into cash. Current Assets can be quickly turned into cash such as debtors and bank accounts.

Liabilities are those things in the business that create debt such as loans, supplier’s invoices, credit cards, etc.

The two types of Liabilities are Current and Long Term. Current Liabilities will typically be paid within a year. Long Tear Liabilities will be held over several years, bank loans and other borrowings.

The Equity in your business is calculated as:

Total Assets less Total Liabilities = Equity

As the business grows and retains more earnings the owner’s equity increases…your business becomes more valuable.

Cash Flow

The biggest issues facing most small and medium businesses is cash flow, or the lack of cash flow. No cash flow results in no profit and ultimately no business. Following the development of a sound Profit and Loss budget I recommend that businesses develop a cash flow forecast that will indicate to the owners and managers when cash will be available to cover expenses and when borrowings may be needed to keep the business liquid. A robust cash flow forecast allows you to manage expenditure and track income and to know your cash position. It also allows you to see an improving cash position or if the position is not improving, allows you to take action.

Your cash flow forecast tracks Cash at Hand, Spending, Loan Repayments, Incoming and Outgoing Cash.

The cash in your business is typically generated via Sales, Borrowings, Sale of Assets, Capital Injection. You will use your cash to pay Wages/Salaries, General Expenses, Purchase Assets, Loan Payments and Owner’s Drawings.

Break Even

This is the amount of sales you need to achieve on a daily, weekly, monthly or on an annual basis to cover your fixed costs.

The break even calculation is your total fixed cost divided by Gross Profit %.

In Example 1 above, it is $25,000 / 40% = $62500. Therefore just to cover your costs you need to sell $62500 of products or services. Only when you sell more than this will you begin to make a profit.

When you know your break even you can avoid being in the red by making appropriate adjustments to the way you do business.

Cost of Doing Business

To complement your break even, it is important in a well-run business to know your Cost of Doing Business (CODB). CODB is the total of your fixed costs, those costs that you incur whether you make a sale or not. Fixed costs can then be divided by any time period you wish.

Example: Yearly fixed costs $200,000 CODB for one year $200,000

Monthly fixed costs $16,667 CODB for one year $16,667

Weekly fixed costs $3846 CODB for one year $3846

It costs you $3846 per week to open the doors before you have sold one product or service.

Cash Gap

Does your business buy products to sell, do you book work for clients and invoice them or maybe you do both?

If so knowing your likely Cash Gap is a critical number for your business. Cash Gap is the time you pay for goods and services to the time you are paid for them. The shorter your Cash Gap, the better your cash flow.

Product A. purchased January 1st….Sold to an Account customer January 20….Invoiced to customer January 25…..Customer on 30 day from end of month terms…Customers pays March 3 Cash Gap = 62 days. Therefore you have funded Product A for 62 days.

Cash Gap can be reduced by Increasing the payables period, decreasing the collection period or increasing the inventory turnover.

From a total company perspective – Reduce the difference between the amount of money you have coming in to the amount of money you have going out.

Accounts Payable and Receivable

Let’s looks at Accounts Payable first. This is the amount of dollars that you owe your suppliers and service providers. A great policy is to develop the habit of paying on time, another great policy is to negotiate the longest payment terms you can. Simply put, the $$$’s are better left in your bank as long as possible but when payments are due, pay on time. On-time payment builds goodwill and if you do ever need a favour you are more likely to get it.

Remember your cash gap…….. increasing your accounts payable terms will assist.

Accounts Receivable

A couple of tips. As a converse to Accounts Payable, negotiating to reduce the time you want to be paid will again assist your cash gap. If your terms are 30 days, negotiate them back to 14 day or less. If you pay on time make it clear to your customers that you expect to be paid on time. Understand your customers’ payment cycles so you can meet their requirements and you don’t get “bumped” into the next month.

Implement an Accounts Receivable follow up process that starts before payment is due, say five days before payment is due. For example, “Hi this is Bob from ABC our invoice no. 12345 is due for payment this Friday. Is there any reason this invoice will not be paid on that date?” Follow this up with regular calls if payment is not made on time. The squeaky wheels gets the oil as they say.

Make sure that the people managing Payables and Receivables have the appropriate skills. Remember you have sold nothing until you have been paid for it.

Key Performance Indicators (KPI’s)

As I mentioned at the outset of this chapter, successful business owners know their numbers. This includes the numbers that indicate how the health of their business is on a daily, weekly or monthly basis. The list of KPI’s is almost endless and will vary by industry and company.

Here are a few you may like to consider tracking:

- Daily customer transactions

- Number of new enquiries

- Conversion rate from enquiry to sale

- Number of new customers verses existing customers

- Average $ sale

- Revenue per sales person

- Stock Turnover

- Billable Hours

- Customer Complaints

- Source of new customers – Advertising, referral, social media, etc

- Days without lost time through injury

- Sales per state or trading areas

- Number of customer transactions

- Sales by hour

- Sales by day…most valuable day

- Debtor days

- Delivery time and accuracy

- Customer’s retention time

- Competitor’s activity

- Dollar conversion rate

And the list is endless. Decide what is important in your business and track the numbers that will assist you to make sound business decisions.

I once had a role with an American business tied to the oil industry…when making decisions one of their key saying was “In God We Trust” quoting from U.S currency “Everyone Else Must Come With Numbers”.

Knowing your numbers will assist you to make more robust business decisions and build a business based on fact not guess work.

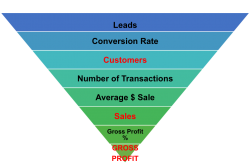

The Profit Levers

As you develop an understanding of your numbers it is important that you understand which levers you need to pull to make improvements.

Many business owners will say “I need more customers” which in itself is correct. However better questions are:

- How many prospects exist in my market and how can I turn them into leads?

- When a lead contacts my business how can I efficiently convert them to customers?

- How can I encourage my customers to spend more, more often with my business?

Prospects – The number of potential customers in your target market.

Leads – The number of prospects who contact your company in a given time period.

Conversion Rate – The number of Leads that you convert into customers.

Equals Customers – Leads 1000 conversion rate 30% customers = 300

Average $ Spend – The average amount your customers spend with you over a given period.

Number of Transactions – The number of times your customers spend with you over a given period

Equals Sales – 300 customers on average spend $100 each 4 times per year

= 300 x $100 x 4 = $120,000

Gross Profit % – 40%

Gross Profit $ – $120,000 x 40% = $48,000 GP$. Remember this is how you pay your fixed expenses.